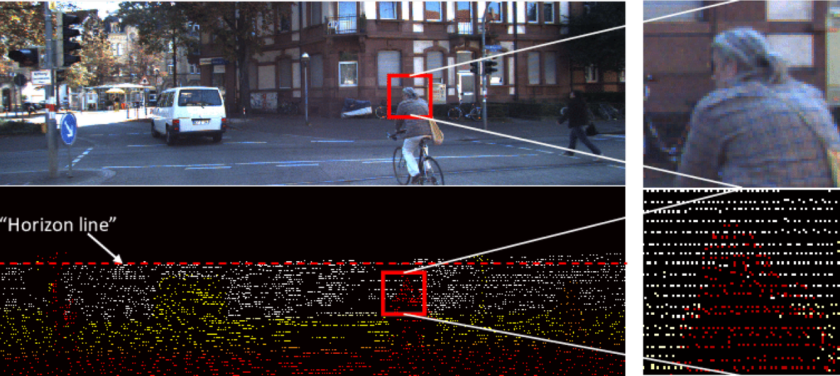

Lately, the global financial market witnessed a quick succession of ‘flash freezes’. A throng of super fast algos is considered as one of the main reasons for these glitches. The algorithms work at a speed, which is beyond human ability to counter and thus, overwhelmed the overall systems.

The financial market makes an unexpected and rapid transition into the cyber jungle inhabited by packs of aggressive trading algorithms.

These algorithms can operate so fast that humans are unable to participate in real time, and instead, an ultrafast ecology of robots rises up to take control. Our findings show that, in this new world of ultrafast robot algorithms, the behavior of the market undergoes a fundamental and abrupt transition to another world where conventional market theories no longer apply,

explains Neil Johnson, professor of physics in the College of Arts and Sciences at the University of Miami (UM), and corresponding author of the study.

The team concluded that as time taken by these ultrafast algo falls below the human response, the number of flash freezes scales considerably. In order to prove their hypothesis, they build a model and concluded that the series of glitches are not caused by human mistake but is an offshoot of ultrafast computer trading.

Johnson, who is heading the research group, compares the event to an ecological environment. He said that if prey and predators are in balance then things would go natural but if we introduce fast predators then they would act before the prior knowledge of prey and hence, would be responsible for extreme events.

So in order to tap the extreme event, understanding the collective behavior of cyber mob becomes imperative asserted Johnson. This new understanding of cyber crowd would help in dealing with cyber-attacks and cyber-warfare, which may or may not come under the financial world.